- Median sales price was up 7.1 percent to $375,000, the slowest increase since June 2020

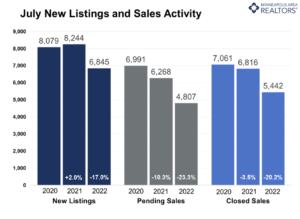

- Buyer activity was down, pending sales fell 23.3 percent

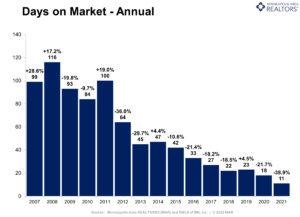

- Homes took 22 days to sell, 15.8 percent longer than the 19 days last July

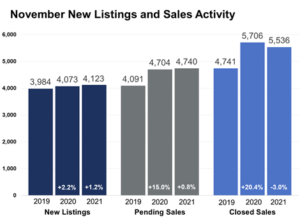

(August 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyers in the Twin Cities have struggled to keep pace with the highs of 2021. Pending sales were down 23.3 percent in July compared to last year as buyers signed 4,807 purchase agreements. Buyers have been hampered by increased mortgage rates, still-low inventory, strong home prices and some economic uncertainty.

Sales & Listings

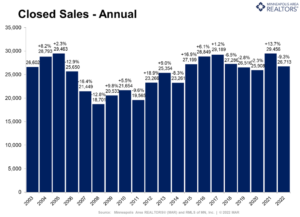

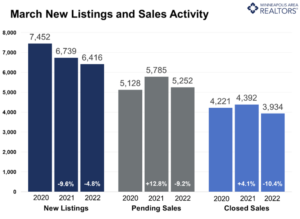

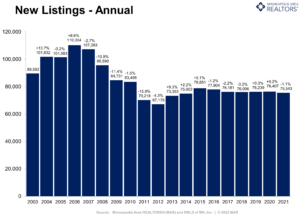

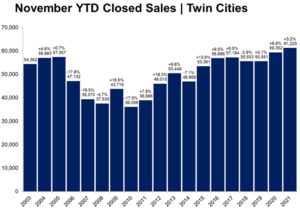

Buyer activity has been softening for 11 of the last 12 months as most acknowledge the frenzied demand of 2020 and 2021couldn’t last. July’s pending sales volume was 12.8 percent lower than July of 2019, reflecting affordability and supply challenges but also hinting at how demand was expedited from 2022/3 into 2020/1. “Many Twin Citizens eager to take advantage of historically low rates and purchase a home leapt at the chance,” said Denise Mazone, President of Minneapolis Area REALTORS®. “Combined with rising rates, that’s left a hole in our buyer pool this year, but there is still plenty of pent-up demand for homes. Plus there’s evidence rates are easing somewhat.” There has not been an influx of supply onto the market. Home sellers listed 6,845 homes last month, down 17.0 percent from last July. Selling activity has been fairly stable overall since 2020, but continuously lagging behind the supply needed to fuel the market demand, until the recent slowdown in sales.

Inventory & Home Prices

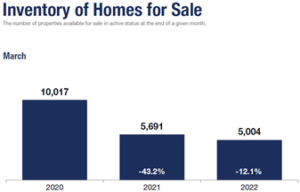

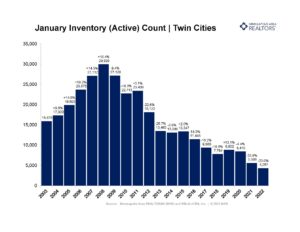

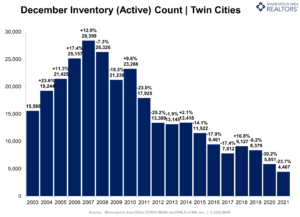

Homes in the metro sold for a median of $375,000 last month, 7.1 percent more than last July. That was the slowest growth rate in two years and amounts to $205 per square foot. The recent downshift in buyer activity has offered a small reprieve for persistent buyers thirsty for inventory and less competition. The metro ended July with 8,694 homes for sale, 4.5 percent more than last July. In a welcome development for buyers, inventory levels have grown for three consecutive months and months supply rose to 1.7. That suggests the supply squeeze is loosening but it’s important to recognize we’re still in a strong seller’s market. “Aspiring home buyers still face competition and multiple offers, just slightly less so than the last couple years, “according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “So while the market has rebalanced slightly, it still favors sellers.”

Location & Property Type

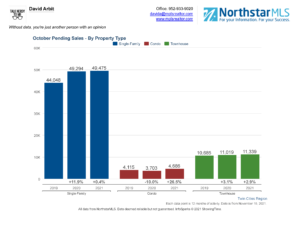

Market activity varies by area, price point and property type. New home sales fell 18.8 percent while existing home sales were down 16.4 percent. Single family sales fell 18.1 percent, condo sales declined 24.5 percent and townhome sales were down 20.8 percent. Sales in Minneapolis decreased 17.5 percent while Saint Paul sales fell 25.0 percent. Cities like Monticello, Golden Valley, and Orono saw the largest sales gains while Stillwater, Chanhassen, and Fridley had lower demand than last year.

July 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,845 properties on the market, a 17.0 percent decrease from last July

- Sellers signed 4,807 purchase agreements, down 23.3 percent (5,442 closed sales, down 20.2 percent)

- Sellers levels grew 4.5 percent to 8,694 units

- Month’s Supply of Inventory rose 13.3 percent to 1.7 months (4-6 months is balanced)

- The Median Sales Price rose 7.1 percent to $375,000

- Days on Market rose 15.8 percent to 22 days, on average (median of 11 days, up 57.1 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 18.1 percent; Condo sales were down 24.5 percent & townhouse sales fell 20.8 percent

- Traditional sales declined 18.9 percent; foreclosure sales fell 12.5 percent; short sales were down 14.3 percent

- Previously owned sales decreased 16.2 percent; new construction sales declined 18.8 percent