New listings and sales up, price growth strong, but some activity from Q2 was postponed into July/August

(September 18, 2020) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyer and seller activity in the 16-county Twin Cities metro both increased from 2019.

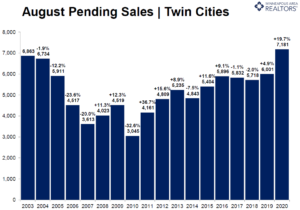

After a 12.0 percent gain in July, the number of signed purchase agreements rose 19.7 percent in August, compared to last year. At 7,181 pending sales, August 2020 had the highest recorded pending sales count for the month, and also the highest for any month of any year going back to June 2004. Although some of the pent-up demand from June and July was shifted into August, recent gains have turned year-to-date pending sales positive—now up 4.3 percent compared to 2019.

“Buyers were truly out in force last month,” according to Linda Rogers, President of Minneapolis Area REALTORS®. “The gains were widespread, with both urban and suburban locations appealing to home buyers.”

Relentless demand and diminished supply have accelerated home price growth. The median sales price in the metro rose 9.8 percent to $315,000. Excluding July of this year, that’s the strongest rate of price growth since March 2018. The median price of a newly built home was around $405,000. Historically low mortgage rates below 3.0 percent can partly offset affordability challenges caused by rising prices.

Despite a modest gain in new listings from last August, buyer demand continued to overwhelm sellers. Multiple offer situations are commonplace, and many sellers are accepting offers above list price. In fact, sellers received, on average, 100.3 percent of their original asking price—matching the 18-year record high from June 2018. A balanced market typically has 5-6 months of supply. At just 1.7 months, sellers are still in the driver’s seat.

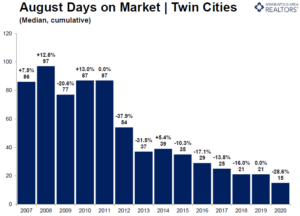

As sales hit a new high, market times reached a new low. Half of the sales occurred in less than 15 days. “People are searching high and low for properties that meet their needs,” said Patrick Ruble, president of the Saint Paul Area Association of REALTORS®. “Attractive rates and a lack of supply means homes won’t last long on the market.”

While an expectation of prolonged tele-commuting has encouraged some to seek more space farther out, it’s notable that Minneapolis and St. Paul saw sales increase 28.1 and 29.2 percent respectively. New listings were also up notably in both cities. Condo sales rose 1.4 percent across the metro but were up 5.6 percent in Minneapolis and down 17.3 percent in St. Paul. The luxury segment has performed quite well recently. Metro-wide sales over $1M surged 51.1 percent from last August.

AUGUST 2020 BY THE NUMBERS COMPARED TO A YEAR AGO

- Sellers listed 7,823 properties on the market, a 1.3 percent increase from last August

- Buyers signed 7,181 purchase agreements, up 19.7 percent (6,765 closed sales, up 0.6 percent)

- Inventory levels fell 32.4 percent to 8,756 units

- Months Supply of Inventory was down 34.6 percent to7 months (5-6 months is balanced)

- The Median Sales Price rose 9.8 percent to $315,000

- Cumulative Days on Market decreased 4.9 percent to 39 days, on average (median of 15, down 28.6 percent)

- Changes in Sales activity varied by market segment

- Single-family sales were up 23.2 percent; condo sales rose 1.4 percent; townhome sales increased 14.8 percent

- Traditional sales rose 20.4 percent; foreclosure sales were up 23.7 percent; short sales fell 28.6 percent

- Previously owned sales were up 18.8 percent; new construction sales climbed 46.4 percent

From The Skinny Blog.