The 13-county Minneapolis-St. Paul metropolitan area housing market continued to settle itself in November. While some measures of housing demand may suggest a slowdown, most deceleration is the result of a healing lender-mediated (foreclosures and short sales) segment, which made up a smaller share of the residential pie compared to last year.

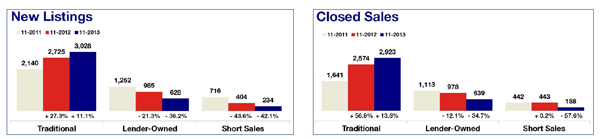

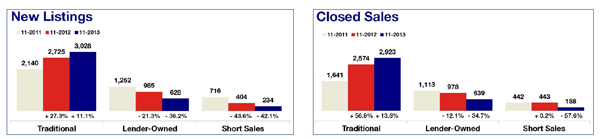

For the first time in seven months, new listings were lower year over year, declining 5.3 percent to 3,900, but traditional new listings rose 11.1 percent over the same time comparison. Buyers closed on 3,760 homes, a 5.9 percent decrease from last November, even though traditional sales were up 13.6 percent. Twin Citizens have 14,126 properties to choose from – or 5.8 percent fewer than last November.

The market-wide median sales price held steady at $195,000 for a third straight month and up 13.4 percent compared to November 2012. Last year, foreclosures and short sales comprised 35.6 percent of all closed sales. In November 2013, these segments made up only 22.1 percent of all sales.

“We are seeing exactly what we want to be seeing,” said Andy Fazendin, President of the Minneapolis Area Association of REALTORS® (MAAR). “Lender-mediated activity once commanded heavy market share, and residential real estate is going to be stronger with fewer foreclosure and short sale properties in the system.”

Traditional new listings rose 11.1 percent, but foreclosure and short sale new listings fell 36.2 and 42.1 percent, respectively. Traditional closed sales rose 13.6 percent; foreclosure and short sale closings fell 34.7 and 57.6 percent. Traditional homes are selling at a median price of $217,000; foreclosures for $133,851; short sales for $150,000.

On average, homes are spending 75 days on the market – quite brisk relative to the past several years. Sellers are receiving an average of 95.4 percent of their original list price – the highest November ratio since 2005. The Twin Cities metro now has 3.2 months’ supply of inventory, which suggests sellers have regained their leverage.

“Some might claim that the recovery is stalling, but the reality is that job growth is gaining momentum and there are fewer distressed properties being listed and sold than at any point in the past five years.” said Emily Green, MAAR President-Elect. “We could stand to see this trend continue into 2014.”