Where has the Twin Cities real estate market been and where is it heading? This monthly summary provides an overview of current trends and projections for future activity. Narrated by Andy Fazendin (2013 President, Minneapolis Area Association of REALTORS®) and Cari Linn (2012 President, Minneapolis Area Association of REALTORS®), video produced by Chelsie Lopez.

Weekly Market Report

The first full week of 2013 market data looks a lot like most of 2012 did. But let’s go beyond the obvious. Consider this: Americans formed substantially more new households in 2012 than we built, which is partly responsible for the ongoing declines in active listings. Our population continues to expand from both natural reproduction and in-migration. But builders and lenders lacked the confidence and risk appetite to build in larger volumes. Unlike our sluggish jobs recovery, this imbalance actually stands to further fuel our fledgling housing recovery. If only all those new households could secure adequate employment, we’d be off to the races.

In the Twin Cities region, for the week ending January 12:

- New Listings decreased 8.0% to 1,120

- Pending Sales increased 4.3% to 722

- Inventory decreased 31.7% to 12,123

For the month of December:

- Median Sales Price increased 15.9% to $168,000

- Days on Market decreased 23.4% to 108

- Percent of Original List Price Received increased 3.5% to 93.8%

- Months Supply of Inventory decreased 42.0% to 2.9

Click here for the full Weekly Market Activity Report.From The Skinny.

Weekly Market Report

With 2012 in the books, we’re starting to see some 2013 activity trickle in. Watch for continuations of last year’s trends: less inventory, strong buyer activity and firmer prices. It’s hard to believe spring is just around the corner, but would-be spring sellers are noticing the changes that have taken place. It’s a much less scary time to sell a home. Foreclosure activity will also be a key metric to watch. For the current cycle, here’s what the data shows.

In the Twin Cities region, for the week ending January 5:

- New Listings decreased 34.6% to 832

- Pending Sales increased 12.7% to 594

- Inventory decreased 31.1% to 12,000

For the month of December:

- Median Sales Price increased 16.2% to $168,452

- Days on Market decreased 23.4% to 108

- Percent of Original List Price Received increased 3.5% to 93.8%

- Months Supply of Inventory decreased 42.0% to 2.9

Click here for the full Weekly Market Activity Report.From The Skinny.

2012 Annual Wrap-Up: Real Market Recovery Takes Hold

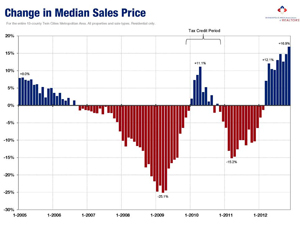

Decreased supply, strong demand and higher prices are among the encouraging developments in 2012 that make the case for continued recovery in 2013. Consumer purchase demand increased organically, absent any government incentives. As the active supply of homes for sale fell to 10-year lows, absorption rates improved to levels also not seen since 2003. Multi-decade low interest rates and record housing affordability resulted in a 16.9 percent increase in home sales for the 13-county metro.

2012 by the Numbers

• Sellers listed 65,914 new homes on the market, a modest 4.3 percent decrease from 2011 and a 10-year low.

• Buyers purchased 48,641 homes, up 16.9 percent from 2011 and the highest figure since 2006 (783 units shy).

• Inventory levels dropped 31.8 percent from 2011 to 11,875 units, the lowest level in 10 years.

• Months Supply of Inventory dropped 42.2 percent to 2.9 months.

• The Median Sales Price of closed sales was up, rising 11.9 percent to $167,900.

• Cumulative Days on Market was down 20.6 percent to 117 days, on average.

• Lender-mediated properties made up a smaller share of overall activity

• 34.6 percent of all New Listings were lender-mediated (either foreclosures or short sales), down from 41.9 percent in 2011 and 42.6 percent in 2010

• 37.3 percent of all Inventory was lender-mediated, down from 44.4 percent in 2011 and 47.4 percent in 2010

• 39.7 percent of all Closed Sales were lender-mediated, down from 50.0 percent in 2011 and 47.9 percent in 2010

Weekly Market Report

The results are mostly in, and the evidence is overwhelming. Housing not only outperformed most other sectors of the economy, but for the first time in half a decade, there was meaningful market recovery in 2012. For 2013, a few things seem likely. Expect interest rates to remain low and rents to rise, which will continue to drive buyer activity. Sellers should return to the marketplace in light of the improvements. Prices should remain firm and show moderate to strong gains. Foreclosure activity and job growth remain wildcards, but momentum is heading in the right direction.

In the Twin Cities region, for the week ending December 29:

- New Listings decreased 40.1% to 358

- Pending Sales decreased 12.6% to 442

- Inventory decreased 30.0% to 12,916

For the month of November:

- Median Sales Price increased 16.4% to $172,200

- Days on Market decreased 26.5% to 103

- Percent of Original List Price Received increased 3.6% to 94.2%

- Months Supply of Inventory decreased 38.6% to 3.5

Click here for the full Weekly Market Activity Report.From The Skinny.

Weekly Market Report

While you’re eating better and exercising more, also resolve to better understand the inner workings of your housing market. Data does not have to be daunting. Just from the existing trends, it’s safe to expect to see more homes selling in less time for closer to list price. It also looks like the single-family detached segment may recover faster than the condo-townhouse attached segment. It would be wise to watch foreclosure activity to see whether there will be fewer low-priced sales in 2013. Many patterns emerge if you look in the right places.

In the Twin Cities region, for the week ending December 22:

- New Listings increased 9.5% to 657

- Pending Sales increased 41.7% to 815

- Inventory decreased 29.2% to 13,315

For the month of November:

- Median Sales Price increased 16.4% to $172,287

- Days on Market decreased 26.5% to 103

- Percent of Original List Price Received increased 3.6% to 94.2%

- Months Supply of Inventory decreased 38.8% to 3.5

Click here for the full Weekly Market Activity Report.From The Skinny.

Weekly Market Report

As we celebrate with family and friends this holiday season, we can take comfort in the fact that housing markets across the country are reaching their own holiday milestones. Even though the trend is our friend, recovery can often feel piecemeal: fewer foreclosures here, improved absorption rates there and lower days on market over there. But, overall, we’ve struck a positive stride, and momentum has a way of accumulating. Here’s a peek at the week’s housing market data.

In the Twin Cities region, for the week ending December 15:

- New Listings decreased 3.6% to 773

- Pending Sales increased 10.1% to 762

- Inventory decreased 28.9% to 13,630

For the month of November:

- Median Sales Price increased 16.2% to $172,000

- Days on Market decreased 26.4% to 103

- Percent of Original List Price Received increased 3.6% to 94.2%

- Months Supply of Inventory decreased 39.5% to 3.4

Click here for the full Weekly Market Activity Report.From The Skinny.

December Monthly Skinny Video

Where has the Twin Cities real estate market been and where is it heading? This monthly summary provides an overview of current trends and projections for future activity. Narrated by Andy Fazendin (2012 President-Elect, Minneapolis Area Association of REALTORS®), video produced by Chelsie Lopez.

Weekly Market Report

The chase to 2013 is on, and we are pleased by the prospects ahead. Given the upward progress of the 2012 housing market, many homeowners may find that their properties will be worth more next year. That’s a nice change of pace for potential sellers, and for residential real estate as a whole, and is a direct result of widespread improvements in the marketplace. Most of the positive trends we have seen in 2012 should persist into the new year. Let’s take a peek at what’s happening locally today.

In the Twin Cities region, for the week ending December 8:

- New Listings increased 3.0% to 942

- Pending Sales increased 12.6% to 788

- Inventory decreased 28.8% to 13,832

For the month of November:

- Median Sales Price increased 16.2% to $172,000

- Days on Market decreased 26.2% to 103

- Percent of Original List Price Received increased 3.6% to 94.2%

- Months Supply of Inventory decreased 40.0% to 3.4

Click here for the full Weekly Market Activity Report.From The Skinny.

Nine Straight Months of Year-Over Year Price Gains

Despite the dramatic arrival of winter, the housing market has retained much of its summer heat. Three decisive trends continued through November: Buyer activity outperformed year-ago levels, inventory dropped and, for a ninth consecutive month, home prices rose compared to 2011. In simpler terms, more homes sold in less time at higher prices and for closer to asking price than last year. During November, 3,843 homes closed, 20.0 percent higher than November 2011. There were 3,587 pending sales, a 12.6 percent increase over last year.

The median sales price was up 16.9 percent to $173,000. The 10K Housing Value Index showed a more modest 9.1 percent increase to $173,113. The number of homes for sale fell 29.4 percent to 13,860 active listings – the lowest number since January 2003. Consequently, seller sentiment has become even more critical to housing recovery. There is evidence of improvement on this front.

The median sales price has risen for nine consecutive months. Less supply, more demand and a healing distressed segment have enabled this trend. Overall, new listings were up 0.2 percent. However, traditional new listings were up 27.8 percent while foreclosure and short sale new listings fell 21.1 and 45.7 percent, respectively. Thus, a pullback in bank-mediated listings has diluted a significant increase in traditional seller activity.

Similarly, closed sales were up 20.0 percent overall, but traditional sales were up 50.4 percent while foreclosures and short sales were down 14.9 and 2.7 percent, respectively. As for the shifting market share, traditional sales made up 64.2 percent of sales, foreclosures 24.6 percent and short sales 11.2 percent.

Months’ supply of inventory fell 40.6 percent to 3.4 months. Figures below 4.0 months of supply are typically hallmarks of sellers’ markets. Homes tended to sell in 104 days, on average, 25.9 percent quicker than last year. Sellers received 94.3 percent of their list price, on average, up from 90.9 percent last year. Conventional financing comprised 48.5 percent of all closed sales; FHA financing was used on 23.1 percent of sales; cash buyers made up 20.6 percent of sales.