“While perhaps we won’t match the growth in the market seen over the last few years, stability and sustainability are the primary objectives.”

Weekly Market Report

For Week Ending June 15, 2019

For Week Ending June 15, 2019

As anticipated, the Federal Reserve did not change the target range for the federal funds rate (currently set at 2.25% to 2.5%) during their most recent meeting, but the door was left open for a possible rate reduction in 2019 following a string of increases over the last several years. Although the economy is still performing well due to low unemployment and solid retail sales, trade tensions, slowed manufacturing and meek business investments have created uncertainty.

In the Twin Cities region, for the week ending June 15:

- New Listings remained flat at 2,069

- Pending Sales decreased 2.0% to 1,463

- Inventory increased 1.0% to 11,687

For the month of May:

- Median Sales Price increased 5.2% to $285,000

- Days on Market decreased 4.3% to 45

- Percent of Original List Price Received decreased 0.2% to 100.0%

- Months Supply of Homes For Sale increased 4.3% to 2.4

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Early 2019 Weakness Proving Temporary; Market Back On Track

June 18, 2019

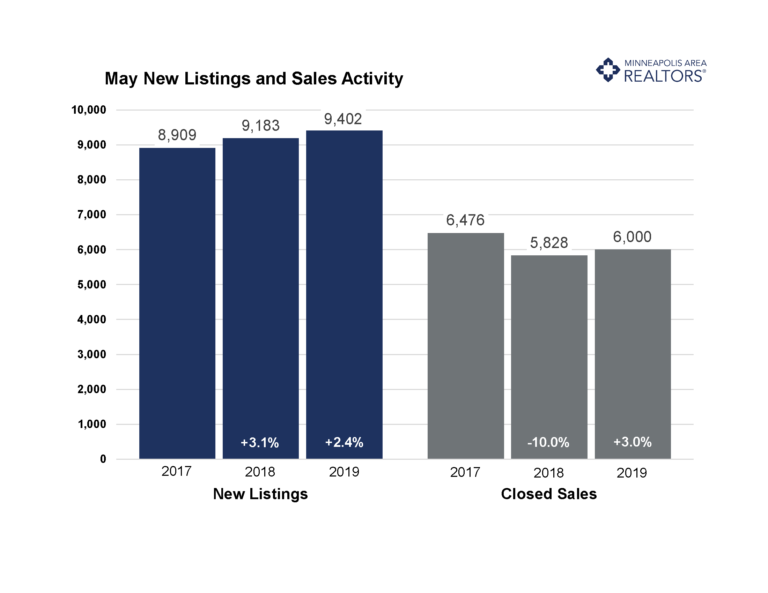

There have been two disruptions to the housing market over the last nine months, but their effects are proving short-lived. First, a sudden increase in interest rates in late 2018 weighed on December and January sales activity. Second, record snow and the subsequent melt in February and March of this year weighed on sales activity in March and April. But May numbers are showing growth in seller activity, pending and closed buyer activity as well as quicker market times and rising prices.

Prices reached a new all-time high of $285,000. New listings rose 2.4 percent while closed sales were up 3.0 percent. After two months of increases, market times sped up by 4.3 percent compared to May 2018. The ratio of sold to list price fell for a fourth consecutive month, but by the smallest amount since February. In conjunction with other indicators, the market is improving for buyers, even though sellers still enjoy strong pricing power, favorable negotiating leverage and quick market times. For the last nine months, buyers have seen more active listings for sale than the year prior. Mortgage rates remain very attractive at around 3.85 percent on a 30-year fixed loan—far lower than anyone predicted by this time. We still have a tale of two markets: strong demand, weak supply and price growth in the affordable brackets but oversupply and slow market times in the upper brackets.

May 2019 by the Numbers (compared to a year ago)

- Sellers listed 9,402 properties on the market, a 2.4 percent increase from last May

- Buyers closed on 6,000 homes, a 3.0 percent increase

- Inventory levels for May increased 0.5 percent compared to 2018 to 11,327 units

- Months Supply of Inventory was flat at 3 months

- The Median Sales Price rose 5.2 percent to $285,000, a record high for any month

- Cumulative Days on Market decreased 4.3 percent to 45 days, on average (median of 17)

- Changes in Sales activity varied by market segment

- Single family sales rose 2.7 percent; condo sales rallied 9.9 percent; townhome sales increased 3.1 percent

- Traditional sales increased 4.4 percent; foreclosure sales declined 26.8 percent; short sales fell 28.6 percent

- Previously-owned sales were up 2.9 percent; new construction sales surged 10.5 percent

Quotables

“We’re still seeing some rebalancing, but it just isn’t as dire as some want us to believe,” said Todd Urbanski, President of Minneapolis Area REALTORS®. “Rates under 4.0 percent is a significant motivator for buyers.”

“Not everyone understands that all real estate is local,” said Linda Rogers, President-Elect of Minneapolis Area REALTORS®. “Shifts in other regions have very little impact on our local market dynamics.”

From The Skinny Blog.

Weekly Market Report

For Week Ending June 8, 2019

For Week Ending June 8, 2019

In terms of relative balance between buyer and seller interests, residential real estate markets across the country continue to perform well on a stage that includes actors such as heightened consumer confidence, wage increases, low unemployment and an economic expansion that is on the verge of being the longest in U.S. history. Well-known players such as increased sales prices and low inventory have recently been joined by fewer new listings in several markets.

In the Twin Cities region, for the week ending June 8:

- New Listings increased 4.1% to 2,187

- Pending Sales decreased 2.0% to 1,467

- Inventory decreased 0.6% to 11,237

For the month of May:

- Median Sales Price increased 5.2% to $285,000

- Days on Market decreased 4.3% to 45

- Percent of Original List Price Received decreased 0.2% to 100.0%

- Months Supply of Homes For Sale increased 4.3% to 2.4

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending June 1, 2019

For Week Ending June 1, 2019

Despite home prices that seem to be creeping ever upward like unchecked crabgrass, pending sales have been performing well, and new listings are generally keeping up with demand in a manner that is propelling the housing industry forward into weed-free pastures. The Federal Reserve considers 2.0% a healthy inflation rate, but the U.S. is expected to remain below that in 2019, which could prompt as many as three rate cuts this year. In turn, that could boost housing further. Excelsior!

In the Twin Cities region, for the week ending June 1:

- New Listings increased 1.2% to 1,839

- Pending Sales increased 6.3% to 1,558

- Inventory remained flat at 11,018

For the month of April:

- Median Sales Price increased 5.2% to $281,000

- Days on Market increased 7.5% to 57

- Percent of Original List Price Received decreased 0.5% to 99.4%

- Months Supply of Homes For Sale increased 5.0% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 25, 2019

The venerable open house is a home-selling marketing tactic that is as old as the business of real estate. Put arrow signs up on busy street corners; buy some balloons; lay out flyers and snacks; welcome the stream of curious lookie-loos that traipse through the home. Many REALTORS® skip this old-fashioned tactic these days, focusing more on Internet marketing, but there are still a lot of arrow signs on street corners this time of year.

In the Twin Cities region, for the week ending May 25:

- New Listings increased 1.2% to 1,839

- Pending Sales increased 6.3% to 1,558

- Inventory remained flat at 11,018

For the month of April:

- Median Sales Price increased 5.2% to $281,000

- Days on Market increased 7.5% to 57

- Percent of Original List Price Received decreased 0.5% to 99.4%

- Months Supply of Homes For Sale increased 5.0% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 18, 2019

For Week Ending May 18, 2019

There is a stillness in the air during this spring’s housing market, and not the foreboding kind that precedes a scary moment in a horror film or a major weather event, but rather a sameness to the springs of the last few years. Prices are still edging upwards and providing affordability challenges for many buyers. The number of new listings and homes for sale are still not quite enough – though improving – to meet current demand. And competition for desirable homes is still fierce.

In the Twin Cities region, for the week ending May 18:

- New Listings decreased 5.9% to 2,147

- Pending Sales decreased 5.8% to 1,395

- Inventory increased 1.0% to 10,553

For the month of April:

- Median Sales Price increased 5.2% to $281,000

- Days on Market increased 5.7% to 56

- Percent of Original List Price Received decreased 0.5% to 99.4%

- Months Supply of Homes For Sale increased 5.0% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

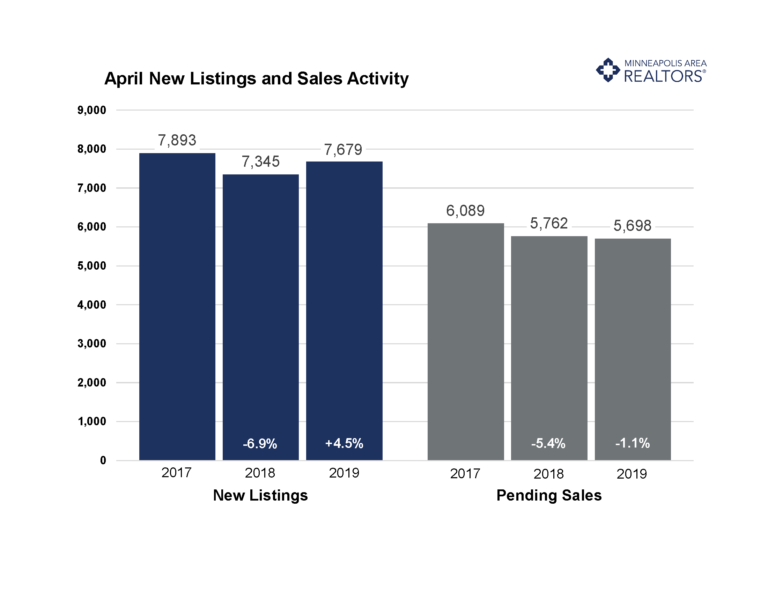

Prices rising, pending sales stable amidst market rebalancing

Gardeners aren’t the only ones struggling with spring weather this year. The season’s late start and temperature swings suppressed housing market activity early this year, but those effects are moderating. The latest numbers for Twin Cities residential real estate show some strength amidst ongoing signs of change. Prices reached a new record of $281,000. New listings reversed course and rose 4.5 percent. Closed sales were down about 7.0 percent though pending sales—a measure of future closings—fell just 1.1 percent. Market times rose 5.7 percent year-over-year, the second increase since March 2015. Another sign of a changing market is the ratio of sold to list price has fallen for five of the last six months. In conjunction with other indicators, this suggests the market is improving for buyers, even though sellers still have strong pricing power, favorable negotiating leverage and quick market times.

The number of active listings for sale decreased slightly compared to the prior year. Even so, buyers have seen inventory gains for seven of the last eight months. After seven months of gains, months supply was flat at 2.0 months, suggesting the market is still undersupplied. Well-priced, turnkey properties continue to be highly sought-after. Mortgage rates remain cooperative at around 4.1 percent, which is good news for buyers. The market is tightest at the entry-level prices, where multiple offers and homes selling for over list price are commonplace. The move-up and upper-bracket segments are less competitive and better supplied.

April 2019 by the Numbers (compared to a year ago)

Sellers listed 7,679 properties on the market, a 4.5 percent increase from last April

Buyers closed on 4,384 homes, a 6.9 percent decrease

Inventory levels for April declined 1.2 percent compared to 2018 to 9,667 units

Months Supply of Inventory was flat at 2.0 months

The Median Sales Price rose 5.2 percent to $281,000, a record high for any month

Cumulative Days on Market rose 5.7 percent to 56 days, on average (median of 21)

Changes in Sales activity varied by market segment

Single family sales declined 7.1 percent; condo sales rose 9.1 percent; townhome sales fell 9.1 percent

Traditional sales decreased 5.2 percent; foreclosure sales declined 30.3 percent; short sales fell 38.9 percent

Previously-owned sales were down 8.9 percent; new construction sales surged 20.3 percent

Quotables

“Things still seem to be rebalancing a bit,” said Todd Urbanski, President of Minneapolis Area REALTORS®. “Low and stable rates have definitely helped, and so has the ongoing economic expansion.”

“We’re doing better here than many other parts of the country,” said Linda Rogers, President-Elect of Minneapolis Area REALTORS®. “It’s important for buyers and sellers to understand local dynamics, not national headlines.”

All information is according to the Minneapolis Area REALTORS® based on data from NorthstarMLS. Minneapolis Area REALTORS® is the leading regional advocate and provider of information services and research on the real estate industry for brokers, real estate professionals and the public. We serve the Twin Cities 16-county metro area and western Wisconsin.

April Monthly Skinny Video

“Buyers are beginning to return in force this Spring. For well-priced homes in desirable locations, competition is fierce.”

Weekly Market Report

For Week Ending May 11, 2019

There is no such thing as a national real estate market. When the median sales price of homes for sale in San Francisco ($1.6 million) are compared to the median annual household income in Youngstown, Ohio ($26,295), it is especially evident. National news outlets will report on housing stories as though one size fits all, but this is particularly untrue in 2019 – not only in terms of home pricing compared to income, but with trends in new listings and pending sales.

In the Twin Cities region, for the week ending May 11:

- New Listings decreased 1.7% to 2,044

- Pending Sales decreased .1% to 1,531

- Inventory increased 1.5% to 10,245

For the month of April:

- Median Sales Price increased 5.2% to $281,000

- Days on Market increased 5.7% to 56

- Percent of Original List Price Received decreased 0.5% to 99.4%

- Months Supply of Homes For Sale increased 5.0% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.