In new construction, home builders continue to struggle to meet buyer demand, as housing starts nationwide dropped 7% last month, according to the Commerce Department.

Like summer, housing remains strong and in-demand but not quite as hot

(September 17, 2021) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, listings throughout the Twin Cities sold quickly and often at or above list price. Though we remain undersupplied, there are signs of inventory stabilizing. The median sales price and price per square foot both increased.

Seller activity was down 3.6 percent while closed sales were up 0.6 percent. Pending sales—the number of signed purchase agreements—fell 10.3 percent from the frenzied pace of 2020 but remain above 2019 levels.

The 6,525 signed purchase agreements in August actually represent an 8.7 percent increase from August 2019. While we may struggle to reach the same level of demand from 2020, this upward trend in demand over two years confirms that buyer interest and activity remains strong. Median days on market fell 33.3 percent from last August to 10 days. This fast paced landscape where multiple offers remain common continues to push prices higher and allows some sellers to accept offers above their asking price.

“Even though these declines have moderated, incoming supply from new listings hasn’t changed much in recent years while, in fact, buyers have become more active,” said Todd Walker, President of Minneapolis Area REALTORS®. “Some of this arises from the fact that last year’s market was atypical and was shifted later into the year than a typical spring and summer market due to COVID.” The metro remains a seller’s market with just 1.4 months supply of inventory. Historically, six months of supply is considered a balanced market. That’s the lowest figure for any August going back to 2003.

The median sales prices remained at a record high of $350,000 for the third straight month. That’s an 11.1 percent increase compared to August 2020. Home prices have likely reached their seasonal peak for the year, but year-over-year increases compared to 2020 are likely to continue. Sellers are also receiving 102.4 percent of their list price, on average.

“Lately, home prices have increased more than the ability of some buyers to afford them,” according to Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “One silver lining is that average 30-year mortgage rates have remained historically low around 2.9 percent through most of the summer. Historically low-interest rates are helping ease the monthly payment of the higher home prices.”

Activity varies by area, price point and property type. Sales of condominiums were up 11.3 percent in Minneapolis and up 17.1 percent in St. Paul. Across the 16-county Twin Cities region new construction sales fell 24.1 percent while previously owned sales rose 3.7 percent. Single-family home sales in Eden Prairie rose 63.0 percent as did those in Cottage Grove by 23.3 percent. Single-family homes in Hudson and Otsego fell, 23.2 percent and 21.3 percent respectively.

August 2021 by the numbers compared to a year ago

• Sellers listed 7,644 properties on the market, a 3.6 percent decrease from last August

• Buyers signed 6,525 purchase agreements, down 10.3 percent (6,858 closed sales, up 0.6 percent)

• Inventory levels fell 20.1 percent to 7,686 units

• Month’s Supply of Inventory was down 26.3 percent to 1.3 months (4-6 months is balanced)

• The Median Sales Price rose 11.1 percent to $350,000

• Days on Market decreased 43.6 percent to 22 days, on average (median of 10 days, down 33.3 percent)

• Changes in Sales activity varied by market segment

-

-

- Condo sales rose 11.3 percent while single family & townhome sales were level with August 2020

- Traditional sales were up 1.9 percent; foreclosure sales were down 71.0 percent; short sales fell 53.3 percent

- Previously owned sales rose 3.8 percent; new construction sales dropped 24.1 percent.

-

Weekly Market Report

For Week Ending September 11, 2021

For Week Ending September 11, 2021

Fall brings good news for those looking to purchase a home, with realtor.com reporting the best time to buy a home is now, according to their Best Time to Buy Report, which analyzed listing data back to 2018. Based on the data, analysts found that the period between Sept. 12 and Oct. 17 will offer the most favorable home buying conditions to prospective buyers, as the majority of U.S. markets are predicted to see more homes for sale, less competition, and increased days on market than at any other time this year.

In the Twin Cities region, for the week ending September 11:

- New Listings decreased 9.0% to 1,680

- Pending Sales decreased 19.5% to 1,141

- Inventory decreased 16.9% to 7,971

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 43.6% to 22

- Percent of Original List Price Received increased 2.1% to 102.4%

- Months Supply of Homes For Sale decreased 26.3% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending September 4, 2021

For Week Ending September 4, 2021

Mortgage rates remained below 3% for the eighth week in a row, with Freddie Mac reporting the 30-year fixed-rate mortgage averaged 2.87% for the week ending September 2nd. Despite persistent low rates, total mortgage applications fell 1.9% compared to the previous week, according to the Mortgage Banker’s Association, with both purchase and refinance applications moderating, as a rise in new COVID-19 cases tempered economic momentum.

In the Twin Cities region, for the week ending September 4:

- New Listings decreased 16.1% to 1,470

- Pending Sales decreased 21.2% to 1,303

- Inventory decreased 17.7% to 7,913

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending August 28, 2021

For Week Ending August 28, 2021

Pending sales were down for a second straight month, falling 1.8% in July, according to the National Association of REALTORS®, as stiff competition for homes and high sales prices have discouraged some would-be buyers. Home prices have been soaring during the pandemic, with the S&P Corelogic Case-Shiller national home price index reporting that prices rose 18.6% nationally in June, the largest annual increase in the history of the index since 1987.

In the Twin Cities region, for the week ending August 28:

- New Listings decreased 10.6% to 1,621

- Pending Sales decreased 8.6% to 1,463

- Inventory decreased 17.8% to 8,014

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending August 21, 2021

For Week Ending August 21, 2021

With the last days of summer on the horizon, experts are expecting an unusually busy fall market, as sellers continue putting more homes on the market, hoping to take advantage of record-high sales prices and strong buyer demand. The National Association of REALTORS® reports the median existing home price was up 17.8% year-over-year, and new listings were up 7.3% in July compared to June, defying seasonality trends typically seen in the fall.

In the Twin Cities region, for the week ending August 21:

- New Listings decreased 5.0% to 1,757

- Pending Sales decreased 11.0% to 1,454

- Inventory decreased 19.5% to 7,906

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

July Monthly Skinny Video

Weekly Market Report

For Week Ending August 14, 2021

For Week Ending August 14, 2021

High home prices are the most common reason prospective buyers have yet to purchase a home, with 39% of active buyers mentioning high sales prices as the primary deterrent to not finding a home in Q2 2021, according to a recent Housing Trends report from the National Association of Home Builders. This is a change from the previous two quarters, where interested buyers reported being outbid by other offers as the most common reason for not purchasing a home.

In the Twin Cities region, for the week ending August 14:

- New Listings decreased 11.7% to 1,697

- Pending Sales decreased 8.0% to 1,503

- Inventory decreased 19.3% to 7,901

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Twin Cities Housing Market Returning to Historic Trends

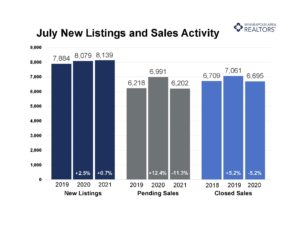

(August 17, 2021) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyer activity in the month of July more closely resembled a typical, pre-pandemic summer than the frenzied buying spree seen over the last year or so. Demand as measured by pending sales was down 11.2 percent from July 2020 but was flat compared to July 2019.

Meanwhile, seller activity in the Twin Cities Metro increased for a fourth consecutive month. The number of homes listed on the market during the month was up 0.7 percent from last year, partly a result of the pullback in seller activity last spring and summer.

“Buyer activity was remarkably strong around this time last year,” said Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “It’s important to put softening sales figures in context. We’re returning to a more typical market in line with the past five years. Compared to the frenzied pace of Summer 2020, that appears to be a slowdown, but it’s really just ‘normalization.’” Overall, sellers are still firmly in control of this market; that hasn’t changed. With just 1.3 months supply of inventory, the metro remains a sellers’ market. Historically, six months of supply is considered a balanced market.

“Buyer activity was remarkably strong around this time last year,” said Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “It’s important to put softening sales figures in context. We’re returning to a more typical market in line with the past five years. Compared to the frenzied pace of Summer 2020, that appears to be a slowdown, but it’s really just ‘normalization.’” Overall, sellers are still firmly in control of this market; that hasn’t changed. With just 1.3 months supply of inventory, the metro remains a sellers’ market. Historically, six months of supply is considered a balanced market.

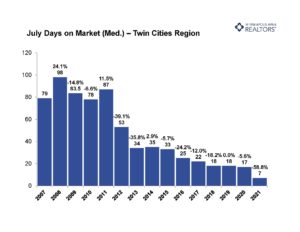

Another hallmark of supply-constrained markets is fast market times. The median number of days a property remained on market declined 58.8 percent to seven days. In other words, half of the pending sales in July had accepted offers within a week of being listed. On the other hand, home prices were up 11.9 percent from last July to arrive at $350,000 for the month. That’s even with June, even though prices tend to reach their seasonal peak in June.

“With offers still coming in at an average of 3.6 percent over original asking price, more people are understanding the strength of this market,” according to Todd Walker, President of Minneapolis Area REALTORS®. “Any supply increase can readily be absorbed by the record demand in the marketplace, and any rebalancing or adjustment will take some time to play out.”

“With offers still coming in at an average of 3.6 percent over original asking price, more people are understanding the strength of this market,” according to Todd Walker, President of Minneapolis Area REALTORS®. “Any supply increase can readily be absorbed by the record demand in the marketplace, and any rebalancing or adjustment will take some time to play out.”

Activity varies by area, price point and property type. Sales of single-family homes were up 3.4 percent in Minneapolis and level in St. Paul, suggesting demand remained strong in the core cities. Condos were the only property type to grow in year over year sales. Across the 16-county Twin Cities region condo sales rose 8.6 percent. Sales of previously owned homes fell 2.5 percent while new construction dropped 23.9 percent.

July 2021 by the numbers compared to a year ago

-

- Sellers listed 8,139 properties on the market, a 0.7 percent increase from last July

- Buyers signed 6,202 purchase agreements, down 11.3 percent (6,695 closed sales, down 5.2 percent)

- Inventory levels fell 25.3 percent to 7,590 units

- Month’s Supply of Inventory was down 35.0 percent to 1.3 month (4-6 months is balanced)

- The Median Sales Price rose 11.9 percent to $350,000

- Days on Market decreased 53.7 percent to 19 days, on average (median of 7 days, down 58.8 percent)

- Changes in Sales activity varied by market segment

- Single family sales were down 5.5 percent; condo sales rose 8.6 percent; townhome sales decreased 5.3 percent

- Traditional sales fell 4.2 percent; foreclosure sales were down 54.5 percent; short sales fell 42.9 percent

- Previously owned sales were down 2.5 percent; new construction sales dropped 23.9 percent

Weekly Market Report

For Week Ending August 7, 2021

For Week Ending August 7, 2021

America’s housing shortage may be starting to ease up, with new listings up 6.5% year-over-year in July, making it the fourth consecutive month of annual increases, according to realtor.com’s Monthly Housing Report. More than half of the nation’s 50 largest metropolitan areas reported double-digit increases in new listings, which may suggest the market is beginning to normalize after the record-breaking activity seen during the pandemic.

In the Twin Cities region, for the week ending August 7:

- New Listings increased 1.7% to 1,939

- Pending Sales decreased 18.6% to 1,414

- Inventory decreased 23.1% to 7,605

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.