The first full week of 2012 shows that buyers were off to a busy start while seller activity cooled down. Sales volumes easily beat the same week in 2011. The inventory drops that many communities saw during the second half of last year should translate into further positive news for sellers. Interest rates are expected to hold the low ground, enriching the buying environment for consumers. It’s early now. The spring market will ultimately be the major tell as to the rate of recovery throughout the year. Today’s lesson: Maintain a long-term perspective and watch trends develop beyond one week of data.

In the Twin Cities region, for the week ending January 7:

- New Listings decreased 14.6% to 1,266

- Pending Sales increased 13.8% to 561

- Inventory decreased 24.5% to 17,302

For the month of December:

- Median Sales Price decreased 6.5% to $145,000

- Days on Market decreased 2.5% to 140

- Percent of Original List Price Received increased 1.7% to 90.6%

- Months Supply of Inventory decreased 35.6% to 4.6

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

Category Archives: The Skinny

Weekly Market Report

Most observers would agree that this year’s housing recovery was not as robust as many had hoped. That said, a handful of things went right. Supply-side market correction took the guise of inventory declines and a pullback in listing activity. Consequently, sellers generally faced fewer challenges than in the past. Driven by improvements in the economy and record-low mortgage rates, purchase demand strengthened organically, independent of government incentives. Those sales gains dovetailed with falling inventories to move the market back toward balance. Nobody knows what 2012 will bring, but it’s a safe bet that these positive developments will continue to evolve.

In the Twin Cities region, for the week ending December 31:

- New Listings decreased 11.6% to 593

- Pending Sales increased 41.7% to 564

- Inventory decreased 24.9% to 18,341

For the month of December:

- Median Sales Price decreased 5.6% to $145,000

- Days on Market decreased 2.4% to 140

- Percent of Original List Price Received increased 1.8% to 90.6%

- Months Supply of Inventory decreased 36.2% to 4.6

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

Weekly Market Report

If you follow our weekly notes with even a sidelong glance, you know that the story of the market in 2011 has been increased sales and decreased inventory. That’s all well and good, but consumers and the media want to talk about one thing: Price. Ideally, sellers seek multiple offers. This signals strong demand and competitive bidding. Buyers want to know that purchasing a home is a financially sound investment. Consumers, whether buyer or seller, want to know when we’ll be establishing a stable real estate foundation again. Which is exactly why the tale of increased sales activity and healthy inventory absorption matters.

In the Twin Cities region, for the week ending December 24:

- New Listings decreased 9.6% to 596

- Pending Sales increased 48.4% to 607

- Inventory decreased 24.4% to 18,666

For the month of November:

- Median Sales Price decreased 10.2% to $149,000

- Days on Market decreased 1.8% to 135

- Percent of Original List Price Received increased 1.0% to 90.9%

- Months Supply of Inventory decreased 29.8% to 5.7

- Inventory decreased 24.4% to 18,666

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

Weekly Market Report

As another new year approaches, we find ourselves settling in for the holidays, which typically come with slowed real estate activity. In the first week of the full holiday shopping season, we saw sales increase. We’re talking about residential real estate, of course, although retail performed surprisingly well, too. Sellers listed fewer properties during the week, choosing instead to hunker down in their living rooms rich with the aromas of pine-scented candles and cinnamon cider sticks.

In the Twin Cities region, for the week ending December 3:

- New Listings decreased 9.3% to 1,006

- Pending Sales increased 36.4% to 885

- Inventory decreased 22.9% to 20,031

For the month of November:

- Median Sales Price decreased 9.9% to $149,500

- Days on Market decreased 1.8% to 135

- Percent of Original List Price Received increased 1.0% to 90.9%

- Months Supply of Inventory decreased 30.5% to 5.7

The attached Weekly Market Activity Report is produced by the Minneapolis Area Association of REALTORS® (MAAR) for REALTOR® members and interested parties on a weekly basis. Use it to further your understanding of the Twin Cities 13-county residential real estate marketplace.

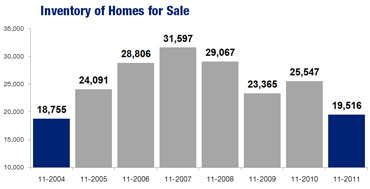

November Housing Inventory Lowest Since 2004

Last month, the number of homes for sale in the 13-county Twin Cities metropolitan area plunged nearly 24.0 percent from last year to 19,516 – the lowest November inventory reading since 2004. In addition, November 2011 marked only the third month in more than five years (68 months to be precise) where there was less than six months supply of inventory. Sellers listed 4,102 new homes on the market, down 13.6 percent from last year. Buyers entered into 3,321 purchase agreements, up 30.2 percent over November 2010.Some sellers are already starting to benefit from less competition. The share of asking price that sellers receive at sale has posted year-over-year increases for the fourth consecutive month. In November, sellers received an average of 90.9 percent of their asking price. That figure was likely helped by the 30.6 percent decrease in months supply of inventory – currently at 5.7 months. Generally, 5 to 6 months is considered balanced.

The median home price was down 10.1 percent from November 2010 to $149,250. Lender-mediated activity (foreclosures and short sales) comprised 44.1 percent of all closed sales and 41.9 percent of new listings.

The first and fourth quarters of the year tend to see the most distressed sales and listing activity. Consequently, traditional prices fell 9.2 percent to $187,400, foreclosure prices dropped 14.3 percent to $98,500 and short sale prices were down 11.5 percent to $130,000.

Market times were down 1.7 percent to 135 days, on average – the second year-over-year decrease in a row. The housing affordability index hit a new record high of 245, meaning that the median household income in the region was 245% of what is necessary to qualify for the median-priced home under prevailing interest rates.