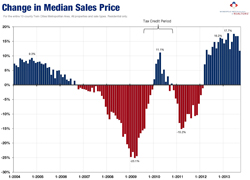

With 4.4 months’ supply of inventory, the absorption rate is consistent with a market transitioning back toward balanced territory, where neither buyers nor sellers have a clear edge. The sales mix continued to skew toward traditional homes that sell in less time and at higher price points. The median sales price rose 5.1 percent to $205,000. That now marks 31 consecutive months of year-over-year price gains.

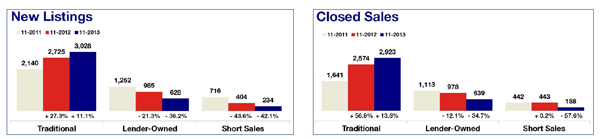

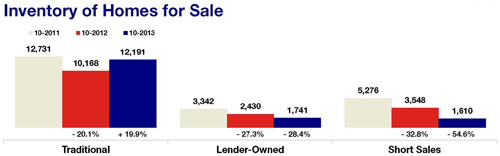

Prices are driven by several factors such as supply and demand but also changes in the sales mix. Looking more deeply at the numbers, a story emerges. While new listings rose 7.2 percent overall, traditional new listings were up 17.9 percent while foreclosure and short sale new listings fell 42.2 and 42.5 percent, respectively. Similarly, overall pending sales were down 1.3 percent, but traditional pending sales rose 9.2 percent while foreclosure and short sale pendings fell 37.0 and 43.3 percent. Market-wide inventory levels increased 8.2 percent, but traditional inventory was up 23.2 percent while foreclosure and short sale inventory levels fell 38.2 and 47.1 percent.

Despite nearly three straight years of rising prices, the Twin Cities housing affordability index has remained relatively stable. The current reading of 186 indicates that the median household income was 86 percent greater than what’s necessary to qualify for the median-priced home under current interest rates. While the index is below its 2012 peak, it remains above its long-term average.

Buyers have more homes from which to choose than they had at any point in 2013 and half of 2012. A growing share of that inventory falls into the traditional segment. Days on market was perfectly even with last year at 71 days. The median list price rose 6.7 percent to $239,900. Price per square foot rose 4.7 percent to $121.

According to the Bureau of Labor Statistics, the Twin Cities currently has the lowest unemployment rate among major metros in the nation at 3.8 percent. The national rate dropped below 6.0 percent for the first time since 2008.