The big story of 2016 was twofold: the median sales price reached an all-time high; while closed sales reached an 11-year high. Closed sales nearly broke their all-time record, but fell 0.3 percent short of their all-time 2004 high. Seller activity declined 1.1 percent. Near-record sales activity combined with flat-to-weaker seller activity created a supply shortage. Active housing supply levels fell to a 14-year low. This shortage has created a competitive environment where multiple offers have become more common. Sellers are receiving strong offers in record time, but this fast-paced market can frustrate some consumers. Days on market fell to a 10-year low. Absorption rates fell to 1.6 months of supply at year-end, a record low. Foreclosure activity fell for a fifth straight year and is back below 2007 levels. Although single-family homes made up about 75.0 percent of all sales, both townhomes and condos showed a stronger increase in sales. Similarly, previously-owned homes made up about 93.0 percent of sales but new construction showed a much stronger increase.

2016 by the Numbers

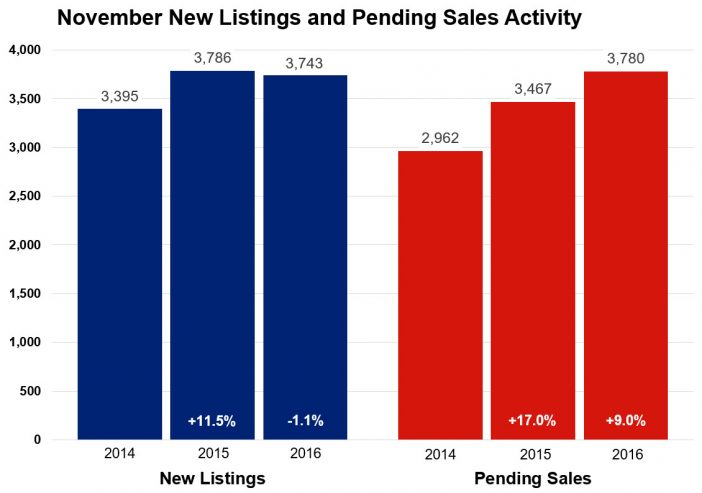

Sellers listed 76,531 properties on the market, a 1.1 percent decrease from 2015

Buyers closed on 59,988 homes, a 6.2 percent increase from 2015 and the highest figure since 2005

Inventory levels for December fell 26.3 percent to 8,197 units compared to 11,125 in 2015—a 14-year low

Months Supply of Inventory was down 30.4 percent to 1.6 months, also a 14-year low

The Median Sales Price rose 5.5 percent to $232,000, which is an all-time record high

Cumulative Days on Market declined 15.8 percent to 64 days, on average (median of 33)—a 10-year record low

Changes in sales activity varied dramatically by market segment

- Single-family sales rose 5.1 percent; condo sales rose 9.5 percent; townhome sales rose 9.9 percent

- Traditional sales rose 10.0 percent; foreclosure sales fell 25.0 percent; short sales fell 31.1 percent

- Previously-owned sales rose 5.7 percent; new construction sales rose 14.9 percent

Poignant Quotables

“The most important achievement of 2016 was erasing the losses in prices and equity caused by the downturn. As sales surpassed their 10-year high, Twin Citizens demonstrated that they are just as committed to homeownership as ever. There are some manageable challenges, but a favorable affordability picture, attractive rates, job growth and wage growth will continue to sustain a healthy real estate market,” said Cotty Lowry, President of the Minneapolis Area Association of REALTORS®.

“We reached some key milestones last year, and hope to continue with this momentum in 2017. It is a great time for those considering listing their home, as buyers are looking for more options. With median sales price at an all-time high, now is a great time to find out the current value of your home,” said Tina Angell, President of the St. Paul Area Association of REALTORS®.

From The Skinny Blog.