For Week Ending May 16, 2020

More than 4.1 million homeowners are now in mortgage forbearance plans, according to the Mortgage Bankers Association’s latest survey. Homeowners affected by COVID-19 with a federally backed home loan can delay mortgage payments for up to a year as part of the CARES Act passed by Congress. While the latest numbers are an increase from last week, it was the smallest increase since March 10th.

In the Twin Cities region, for the week ending May 16:

- New Listings decreased 27.5% to 1,599

- Pending Sales decreased 8.0% to 1,341

- Inventory decreased 13.6% to 9,791

For the month of April:

- Median Sales Price increased 8.9% to $305,000

- Days on Market decreased 17.5% to 47

- Percent of Original List Price Received increased 0.5% to 99.9%

- Months Supply of Homes For Sale decreased 13.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

April Monthly Skinny Video

April’s median sales price was up 8.9% compared to April of last year.

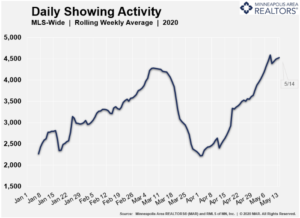

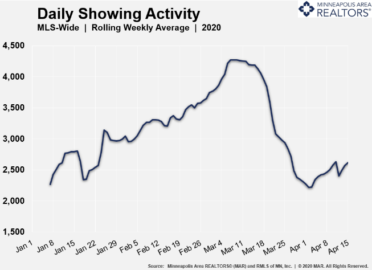

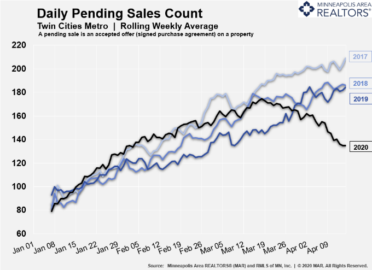

Record high showings the bright spot in April housing numbers

(May 21, 2020) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both buyer and seller activity was down in April, but the number of residential showings has reached a new high for the year.Both new listings and pending purchase activity was down in April compared to a year ago, but the declines varied dramatically by price range. For homes priced between $350,000 and $500,000, for example, sellers listed just 7.8 percent fewer homes than last April. Homes priced over $1,000,000, however, saw a 44.9 percent decrease in new listings. New listings at the far-affordable end of the market also saw notable declines.

“March started off strong and that strength returned later in April and into May; however, the latter half of March and the start of April saw set-backs due to COVID-19,” said Patrick Ruble, President of the Saint Paul Area Association of REALTORS®. “REALTORS® are busy, and we’ve seen gains for both buyers and sellers in late-April and May.”

The price gains in April may surprise some. In fact, April was the first month on record where the median home price surpassed $300,000. Home prices and closed sales both rose in April, reflecting purchase agreements signed in February and the first half of March. Homes actually sold more quickly this April than last, as health concerns held back some less serious buyers but motivated buyers who remained active and committed.

“We expected much of the pull-back resulting from COVID-19 would show up in April, so the shift isn’t that surprising,” said Linda Rogers, President of the Minneapolis Area REALTORS®. “But showings are a leading indicator for purchase activity and they’ve reached new highs for the year. We expect this to translate into stronger sales activity once the health situation stabilizes.”

The recent job losses have impacted some market segments more than others. Buyers in the affordable brackets are more likely to be impacted by job losses in the leisure, hospitality or retail space, while those looking in the luxury brackets may be impacted by volatility in equity markets. The middle-market ranges performed the best, perhaps propped up by salaried professionals who can work from home.

For April, the median Twin Cities home price was up 8.9 percent to $305,000, a new high for the metro area. Mortgage rates on a 30-year fixed loan are around 3.4 percent—just about the lowest they have ever been. While recessions can pause market activity, they typically only have a minor impact on home prices. The undersupplied market—especially at the affordable end—should also prevent any price softening.

April 2020 by the numbers compared to a year ago

- Sellers listed 5,967 properties on the market, a 22.9 percent decrease from last April

- Buyers signed 4,612 purchase agreements, down 20.1 percent (4,609 closed sales, up 3.5 percent)

- Inventory levels declined 13.1 percent to 9,279 units

- Months Supply of Inventory was down 18.2 percent to8 months (5-6 months is balanced)

- The Median Sales Price rose 8.9 percent to $305,000 (over $300,000 for the first time ever)

- Cumulative Days on Market decreased 17.5 percent to 47 days, on average (median of 17)

- Changes in Sales activity varied by market segment

- Single family sales rose 11.1 percent; condo sales were down 33.2 percent; townhome sales declined 5.3 percent

- Traditional sales increased 5.0 percent; foreclosure sales dropped 33.7 percent; short sales fell 43.5 percent

- Previously owned sales were up 4.9 percent; new construction sales climbed 4.7 percent

Weekly Market Report

For Week Ending May 9, 2020

This week ATTOM Data Solutions released their Q1 2020 U.S. Home Equity and Underwater Report, showing that just over one in four homeowners have at least 50% equity in their homes. The Mortgage Bankers Association reported that mortgage applications were up again last week, which is further sign of strengthing buyer interest as much of the country sees a gradual softening of stay-at-home orders due to COVID-19.

In the Twin Cities region, for the week ending May 9:

- New Listings decreased 17.3% to 1,727

- Pending Sales decreased 22.6% to 1,232

- Inventory decreased 13.5% to 9,550

For the month of April:

- Median Sales Price increased 8.9% to $305,000

- Days on Market decreased 17.5% to 47

- Percent of Original List Price Received increased 0.5% to 99.9%

- Months Supply of Homes For Sale decreased 13.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending May 2, 2020

The Mortgage Bankers Association reported a 12% increase in mortgage applications last week, reversing a trend of falling activity due to the COVID-19 pandemic. While a positive sign of buyer interest and future home buying activity, application volume was still 20% lower than a year ago. Initial unemployment claims came in at a little more than 3.8 million for the week ending April 25th, which continues the decline seen in recent weeks but still significantly higher than pre-pandemic levels.

In the Twin Cities region, for the week ending May 2:

- New Listings decreased 28.6% to 1,476

- Pending Sales decreased 17.8% to 1,149

- Inventory decreased 12.2% to 9,413

For the month of March:

- Median Sales Price increased 8.0% to $297,000

- Days on Market decreased 7.6% to 61

- Percent of Original List Price Received increased 0.6% to 99.2%

- Months Supply of Homes For Sale decreased 10.0% to 1.8

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending April 25, 2020

While the initial unemployment insurance claims number was down from last week, claims remain at a high level with over 4.4 million people filing for the first time in the latest Department of Labor report. Weekly initial claims are likely to continue to decrease in coming weeks while still remaining significantly elevated. Mortgage rates have stabilized over the last few weeks at nearly three-quarters of a percent lower than a year ago, while showing activity nationwide has increased 39% in the last two weeks as agents and consumers are adapting to the new environment, including using virtual showings in many cases.

In the Twin Cities region, for the week ending April 25:

- New Listings decreased 30.7% to 1,376

- Pending Sales decreased 24.3% to 1,071

- Inventory decreased 11.1% to 9,161

For the month of March:

- Median Sales Price increased 8.0% to $297,000

- Days on Market decreased 7.6% to 61

- Percent of Original List Price Received increased 0.6% to 99.2%

- Months Supply of Homes For Sale decreased 10.0% to 1.8

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending April 18, 2020

The Department of Labor’s initial jobless claims report released April 16th showed 5,245,000 new weekly claims, which is a decrease of nearly 1.4 million from last week. New initial claims are expected to continue to decline but still remain at high levels in the next few weeks. This week the Commerce Department reported new construction building permits were at a seasonally adjusted annual pace of 1.35 million in March, which is 5% higher than last year. However, that is expected to decline in April as the impact of COVID-19 is more fully realized.

In the Twin Cities region, for the week ending April 18:

- New Listings decreased 23.9% to 1,228

- Pending Sales decreased 27.8% to 989

- Inventory decreased 12.0% to 9,025

For the month of March:

- Median Sales Price increased 8.0% to $297,000

- Days on Market decreased 7.6% to 61

- Percent of Original List Price Received increased 0.6% to 99.2%

- Months Supply of Homes For Sale decreased 10.0% to 1.8

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

March Monthly Skinny Video

Sales were up compared to last year – a welcome and reassuring direction in a low supply marketplace.

Weekly Market Report

For Week Ending April 11, 2020

This week’s initial jobless claims report from the Department of Labor showed another 6.6 million workers filed last week and revised the prior week’s claims up by 219,000 to nearly 6.9 million. Millions of additional initial jobless claims are likely to be reported in the next few weeks as the full impact of shelter-in-place policies becomes apparent. Meanwhile, Freddie Mac reported that the average 30-year fixed-rate mortgages rate remained flat at 3.33% this week, down from an average of 4.12% a year ago.

In the Twin Cities region, for the week ending April 11:

- New Listings decreased 30.4% to 1,210

- Pending Sales decreased 21.0% to 1,000

- Inventory decreased 11.3% to 8,928

For the month of March:

- Median Sales Price increased 8.0% to $297,000

- Days on Market decreased 9.1% to 60

- Percent of Original List Price Received increased 0.6% to 99.2%

- Months Supply of Homes For Sale decreased 10.0% to 1.8

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

A silver lining: Some early signs of turnaround in showings

(April 17, 2020) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the number of Twin Cities residential real estate showings displayed the first signs of a turnaround since they began declining during the onset of the coronavirus in mid-March.Since reaching their valley around April 2, showings have been on the rise. As of April 10, overall showings were up 16.1 percent compared to a week earlier. Reduced activity during the Easter and Passover holidays eroded that gain slightly, but that is likely a temporary blip.

“Despite some concerns among buyers and sellers, there’s clearly still activity occurring,” said Linda Rogers, President of Minneapolis Area REALTORS®. “It is still vital that REALTORS® continue to follow best practices for showing homes safely and to consider other options such as virtual tours.”

“Despite some concerns among buyers and sellers, there’s clearly still activity occurring,” said Linda Rogers, President of Minneapolis Area REALTORS®. “It is still vital that REALTORS® continue to follow best practices for showing homes safely and to consider other options such as virtual tours.”

Both new listings and pending sales also saw declines in the second half of March and into April. New listings began to decline around March 26 and are now roughly 36.8 percent below their 2020 peak. The decline in buyer activity was earlier but not as severe. Pending sales began to decline around March 18 and are now about 19.1 percent below their peak.

“March was off to a strong start until the middle of the month when everything changed,” said Patrick Ruble, President of St. Paul Area Association of REALTORS®. “We even saw a double-digit gain in new listings, providing more options for buyers facing limited choices. The strength of the market preceding this crisis bodes well for a relatively quick recovery once this crisis is over.”

The monthly report for March, with its 16.0 percent gain in new listings and 11.2 percent increase in pending and closed sales, paints only a partial picture of COVID-19’s impact on the market. The numbers don’t fully reflect the effect of the stay-at-home order and school closures which occurred in the second half of the month. And most March sales were for purchase agreements that were finalized in January and February. The April numbers will offer a far more accurate view of COVID-19’s impact on the Twin Cities housing market – from sales, listings and inventory to market times and home prices.

For March, the median Twin Cities home price was up 8.0 percent to $297,000. Mortgage rates on a 30-year fixed loan are now around 3.4 percent—just about the lowest they’ve ever been. While recessions can pause market activity, they typically have only a minor impact on home prices. The undersupplied market—especially at the affordable end—should also shield prices.

March 2020 by the numbers compared to a year ago

- Sellers listed 7,220 properties on the market, a 16.0 percent increase from last March

- Buyers signed 5,148 purchase agreements, up 11.2 percent (4,155 closed sales, also up 11.2 percent)

- Inventory levels declined 11.3 percent to 8,597 units

- Months Supply of Inventory was down 15.0 percent to7 months (5-6 months is balanced)

- The Median Sales Price rose 8.0 percent to $297,000

- Cumulative Days on Market decreased 9.1 percent to 60 days, on average (median of 26)

- Changes in Sales activity varied by market segment

- Single family sales rose 13.5 percent; condo sales were up 8.4 percent; townhome sales increased 8.1 percent

- Traditional sales increased 13.6 percent; foreclosure sales dropped 34.6 percent; short sales fell 9.5 percent

- Previously owned sales were up 13.5 percent; new construction sales climbed 5.9 percent

For more information on weekly and monthly housing numbers visit www.mplsrealtor.com.

From The Skinny Blog.