Author Archives: admin

Home prices hit $370,000 as rates push affordability to lowest level since 2004

- Both pending and closed home sales were down about 9.0 percent from last April

- Inventory was down 9.2 percent to 5,758 units, the twenty-fifth consecutive month of declines

- Median Sales Price reached a record $370,000, up 10.0 percent from last year

(May 16, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the Twin Cities metro area saw rising prices, fast market times and strong offers—often over asking price—during April. But rising mortgage rates have forced the affordability index below 100 for the first time since at least 2004.

HOME PRICES & INVENTORY

While the median home price rose 10.0 percent to reach a new record of $370,000—and will likely do so again over the next couple months—declines in affordability have continued to weigh on some buyers who are already fatigued from writing several offers. Historically low interest rates have been offsetting the effect of rising prices on monthly mortgage payments. But that’s quickly changing as the Federal Reserve races to combat high inflation by raising rates. Even so, the long-term average 30-year fixed mortgage rate is about 8.0 percent, above where we currently stand at around 5.2 percent. The affordability index fell to 95, meaning the median income was 95.0 percent of the necessary income needed to qualify for the median priced home under prevailing interest rates.

Despite affordability concerns, the supply-demand imbalance will likely keep prices firm. Some buyers may need to re-evaluate their target price to keep monthly payments at a level they’re comfortable with. We ended April with 5,758 homes on the market, 9.2 percent fewer than April 2021 and the twenty-fifth straight month of year-over-year inventory declines. This amounts to just 1.1 months’ supply of inventory, giving sellers the upper hand (a balanced market has four to six months’ supply). “Even with several justifiable concerns, this market continues to outperform,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®.

LISTINGS & SALES

Due to several factors, buyer activity has moderated somewhat. First, we’re comparing against the highs of the Covid housing craze from last spring. Second, inventory is even lower and further pressuring sales. Third, rising rates have likely taken some buyers out of the market. Buyers signed 9.2 percent fewer purchase agreements than April of last year and closed on 9.0 percent fewer homes. Sellers listed 7.0 percent fewer homes than last April. Sellers may feel attached to their interest rate and reluctant to list their homes to avoid higher interest rates.

While still high, it’s possible inflation has peaked. Financial experts report that annual inflation moderated for the first time in months. “It’s the rates and payment piece that is of concern to many of the buyers I work with,” said Denise Mazone, President of Minneapolis Area REALTORS®. “The reality is that people will need to buy and sell homes in any environment, but this really puts pressure on those who are on a budget.” Listings spent 9.7 percent fewer days on market than April 2021 on average. But the median days on market showed half of all homes went under contract in under 8 days, which is even with last April’s pace. This could be a sign of stabilization, yet sellers accepted offers 3.8 percent higher than their list price, on average.

LOCATION & PROPERTY TYPE

Market activity varies by area, price point and property type. New and existing home sales fell 3.5 and 8.0 percent, respectively. Single family sales fell 8.3 percent while condo sales rose 1.5 percent. Sales in Minneapolis declined 3.2 percent while Saint Paul sales fell 17.7 percent. The Longfellow, University, Summit Hill and West Seventh neighborhoods saw the largest sales gains while Hopkins, Mounds View, Wyoming and Somerset also had significant demand increases.

APRIL 2022 BY THE NUMBERS (COMPARED TO A YEAR AGO)

- Sellers listed 7,046 properties on the market, a 7.0 percent decrease from last April

- Buyers signed 5,693 purchase agreements, down 9.2 percent (4,706 closed sales, down 9.0 percent)

- Inventory levels fell 9.2 percent to 5,758 units

- Month’s Supply of Inventory remained level at 1.1 month (4-6 months is balanced)

- The Median Sales Price rose 10.0 percent to $370,000

- Days on Market fell 9.7 percent to 28 days, on average (median of 8 days, same as April 2021)

- Changes in Sales activity varied by market segment

- Single family sales decreased 8.3 percent; Condo sales rose 1.5 percent & townhouse sales declined 10.9 percent

- Traditional sales were down 7.8 percent; foreclosure sales fell 24.2 percent; short sales were up 25.0 percent (from 4 to 5)

- Previously owned sales declined 8.0 percent; new construction sales fell 3.5 percent

April 2022 HOUSING CHARTS

From The Skinny Blog.

Weekly Market Report

For Week Ending May 7, 2022

For Week Ending May 7, 2022

Demand for adjustable-rate mortgages (ARMs) is rising, as buyers look to mitigate higher monthly payments caused by record-high sales prices and surging mortgage interest rates. Although less popular than fixed rate mortgages, ARMs offer introductory rates lower than rates from conventional mortgages and currently represent 11% of mortgage loans, up from 3% at the beginning of the year, according to the Mortgage Bankers Association.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 7:

- New Listings decreased 5.7% to 1,808

- Pending Sales decreased 11.6% to 1,406

- Inventory decreased 5.2% to 5,811

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending April 30, 2022

For Week Ending April 30, 2022

70% of metropolitan areas saw the median existing-home sales price rise by double digits annually in the first quarter of 2022, up from 66% of metro areas in the previous quarter, according to the National Association of REALTORS® (NAR) latest quarterly report. In 27 U.S. markets, buyers needed at least $100,000 annual income to afford a 10% down payment, with first time buyers typically spending 28.4% of monthly income on mortgage payments, exceeding the 25% threshold NAR considers unaffordable.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 30:

- New Listings decreased 4.8% to 1,731

- Pending Sales decreased 9.3% to 1,424

- Inventory decreased 6.9% to 5,576

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,077

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending April 23, 2022

For Week Ending April 23, 2022

Home sales prices continue to reach new heights, and record gains in equity are motivating an increasing number of sellers to put their homes up for sale, according to Homelight’s 2022 Buyer and Seller Insights Report. With multiple offers common in many markets, many homeowners have high expectations when it comes to the sale of their home. More than 40% of sellers believe their home will sell for more than asking price, and about half of those surveyed expect to retain 30% or more of the sale price as a profit.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 23:

- New Listings decreased 0.6% to 1,759

- Pending Sales decreased 22.8% to 1,176

- Inventory decreased 10.9% to 5,278

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,000

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending April 16, 2022

For Week Ending April 16, 2022

Builder confidence softened for the fourth straight month in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index, as escalating sales prices, higher construction costs, and increasing mortgage rates continue to impact housing affordability. With the average sales price of a new home upwards of $500,000 as of last measure, builders report sales traffic and sales conditions have fallen to their lowest points since last summer.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 16:

- New Listings decreased 12.8% to 1,454

- Pending Sales decreased 6.3% to 1,406

- Inventory decreased 13.2% to 5,103

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,000

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

March Monthly Skinny Video

Weekly Market Report

For Week Ending April 9, 2022

For Week Ending April 9, 2022

Rising mortgage interest rates are taking a toll on borrowers, having increased more than 1.5 points since the beginning of the year, the fastest three-month rate increase since 1994, according to Freddie Mac. The recent surge in mortgage rates has caused a decline in mortgage demand, with the Mortgage Bankers Association (MBA) reporting the Refinance Index is down 62% compared to a year ago, while the unadjusted Purchase Index is 6% lower compared to this time last year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 9:

- New Listings decreased 13.8% to 1,503

- Pending Sales increased 3.3% to 1,326

- Inventory decreased 12.1% to 4,990

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $353,950

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Limited inventory pushes median price over $350,000 as spring market heats up

- Supply is down during the worst inventory shortage in decades

- Median Sales Price reaches a record $353,000

- Median days on market is up marginally compared to the frenzy of 2021

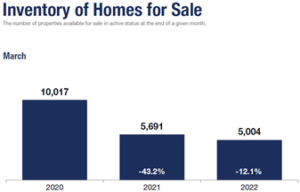

(April 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the Twin Cities metro area set a new record median sales price of $353,000, a 7.5 percent increase from March 2021. Even though that’s the first time the metro-wide median price exceeded $350,000, the rate of increase is 30.0 percent less than it was a year ago. The ongoing inventory shortage is mostly to blame, although the 12.0 percent decline in housing inventory this March was far less than the 43.0 percent decline last March.

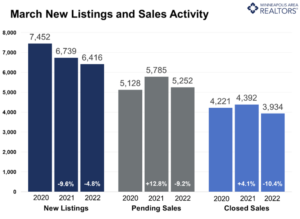

LISTINGS & SALES

Last month sellers listed 6,416 homes on the market, 4.8 percent fewer than March 2021, but 4.2 percent greater than 2019. Some aging empty nesters are staying put and aging in place while others have chosen to remodel or expand their current home instead of listing it. Many homeowners are “married” to their interest rates and are reluctant to give up their monthly payments given rising rates. Buyers signed 9.2 percent fewer purchase agreements than March of last year and closed on 10.4 percent fewer homes. The declines partly reflect the unique strength of the 2021 market but also possibly a reaction to increased mortgage rates.

The monthly payment on a $350,000 home with 10.0% down increases by $187 per month when rates move from 4.0 to 5.0 percent. “Some buyers are trying to get ahead of further rate increases,” said Denise Mazone, President of Minneapolis Area REALTORS®. “But the truth is that equity gains over time are likely to outpace the slightly higher payments.” Listings spent 10.3 percent fewer days on market than last March on average, after a 36.1 percent decline the year prior. But the median days on market showed a year-over-year increase for only the third time since September 2019. This could be a sign of a more balanced market. Yet sellers accepted offers 2.7 percent higher than their list price, on average.

HOME PRICES & INVENTORY

Home price are expected to continue rising given a chronically undersupplied market with strong demand, but perhaps at a lesser rate. The median price rose 7.5 percent to $353,000; the average price rose 7.0 percent to $409,754—both record highs. On average, buyers are spending about $200 per square foot. The Twin Cities presently has about four week’s supply of inventory (0.9 months), while a balanced market has roughly four to six months’ supply. But over a decade of underbuilding has meant steep competition for most listings. That coincides with a huge Millennial generation aging into prime homeownership years, not to mention the desire for more space for working and learning from home. Even though inventory levels were down, there are signs that supply is beginning to stabilize. “While inventory levels remain low, there are listings that come on market and go under contract quickly that don’t always show up in the month-end inventory count,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®.

LOCATION & PROPERTY TYPE

Market activity varies by area, price point and property type. New home sales rose 1.4 percent compared to a 10.5 percent dip for previously owned homes. Single family sales fell 9.3 percent while condo sales were down 5.3 percent. Sales in Minneapolis declined 8.8 percent while Saint Paul sales were down 18.2 percent. Hastings, Hugo and Lino Lakes saw the greatest increase in closed sales while Prior Lake, Richfield and Minnetonka saw sales fall by 35.0 percent or more.

MARCH 2022 BY THE NUMBERS (COMPARED TO A YEAR AGO)

- Sellers listed 6,416 properties on the market, a 4.8 percent decrease from last March

- Buyers signed 5,252 purchase agreements, down 9.2 percent (3,934 closed sales, down 10.4 percent)

- Inventory levels fell 12.1 percent to 5,004 units

- Month’s Supply of Inventory was down 10.0 percent to 0.9 months (4-6 months is balanced)

- The Median Sales Price rose 7.5 percent to $353,000

- Days on Market fell 10.3 percent to 35 days, on average (median of 12 days, up 9.1 percent from March 2021)

- Changes in Sales activity varied by market segment

- Single family sales decreased 9.3 percent; Condo sales fell 5.3 percent & townhouse sales declined 10.3 percent

- Traditional sales were down 9.2 percent; foreclosure sales fell 6.9 percent; short sales were up 28.6 percent (from 7 to 9)

- Previously owned sales dropped 10.5 percent; new construction sales rose 1.4 percent

MARCH 2022 HOUSING CHARTS

From The Skinny Blog.

Weekly Market Report

For Week Ending April 2, 2022

For Week Ending April 2, 2022

The median national home price recently hit a new all-time high of $405,000 in March, a 13.5% increase annually, according to Realtor.com’s latest Monthly Housing Trends Report. As home prices continue to rise, the share of homes experiencing price reductions has also grown, with 25 of the 50 largest metro areas reporting an increase in price reductions last month, up from 18 in February, which may be an early sign the housing market is moderating somewhat.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 2:

- New Listings increased 0.2% to 1,500

- Pending Sales decreased 11.4% to 1,238

- Inventory decreased 11.8% to 4,986

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 8.3% to $340,000

- Days on Market decreased 4.3% to 44

- Percent of Original List Price Received increased 0.7% to 100.8%

- Months Supply of Homes For Sale decreased 10.0% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.