“Housing is still relatively affordable.”

www.mplsrealtor.com

Monthly Archives: December 2018

Weekly Market Report

For Week Ending December 15, 2018

The U.S. Federal Reserve recently raised the benchmark borrowing rate to a range of 2.25 to 2.50 percent. It is the fourth increase in 2018 and brings the rate to its highest level in a decade. As a result, borrowing money will be more expensive, particularly for credit card purchases. Fed Chair Jerome Powell stated that a rate increase at this time was appropriate for a healthy economy. Fed actions do not necessarily affect mortgage rates, but they can be influential.

In the Twin Cities region, for the week ending December 15:

- New Listings increased 9.5% to 702

- Pending Sales decreased 6.7% to 723

- Inventory increased 1.0% to 9,487

For the month of November:

- Median Sales Price increased 8.2% to $265,000

- Days on Market decreased 7.1% to 52

- Percent of Original List Price Received decreased 0.1% to 97.3%

- Months Supply of Inventory increased 10.5% to 2.1

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Long-awaited inventory gains finally arrive

By David Arbit on Tuesday, December 18th, 2018

For the first time since April 2015, there were more homes listed for sale in the Twin Cities metro than the same month the year prior. After years of strong buyer activity and weak seller activity, the tides seem to finally be shifting. Seller activity has been accelerating since the middle of this year. Meanwhile, the last four months all showed year-over-year decreases in pending sales. Unit sales volumes are still healthy, though there is some downward pressure brought on by tight inventory and rising prices and rates. The market is decelerating, but not yet contracting. Prices continue to rise, and homes are selling in less time. But absorption rates and the ratio of sold to list price are starting to ease. That’s good news for buyers, even though sellers still have strong negotiating power.

The number of active listings for sale has increased compared to the prior year. Buyers haven’t seen inventory gains in over 3.5 years. Months supply also ticked up to 2.1 months, suggesting the market is still tight but it is rebalancing and normalizing. After increasing in October and November, rates have settled back down around September levels. The lack of supply is especially noticeable at the entry-level prices, where multiple offers and homes selling for over list price are commonplace. The move-up and upper-bracket segments are less competitive and—for the most part—much better supplied. Inventory could double while sales remain stable and we’d still have less than 5 months of supply.

November 2018 by the Numbers (compared to a year ago)

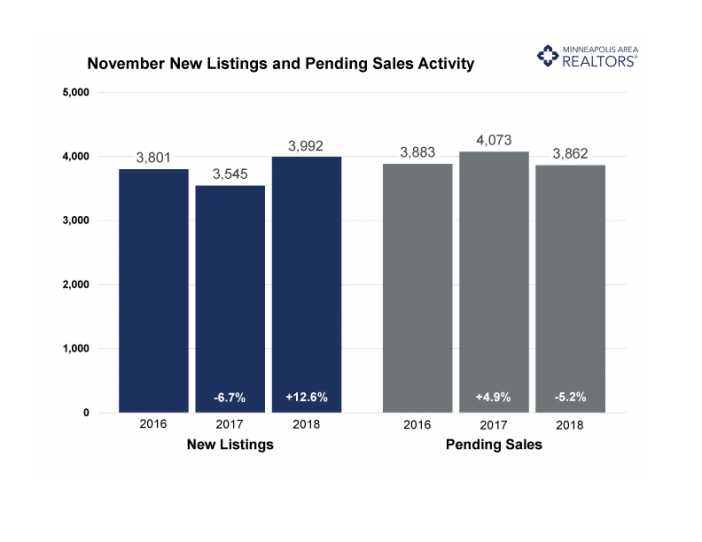

Sellers listed 3,992 properties on the market, a 12.6 percent increase from last November

Buyers closed on 4,629 homes, a 0.9 percent decrease

Inventory levels for November rose 2.3 percent compared to 2017 to 10,181 units

Months Supply of Inventory was increased 10.5 percent to 2.1 months

The Median Sales Price rose 8.2 percent to $265,150, a record high for November

Cumulative Days on Market declined 7.1 percent to 52 days, on average (median of 31)

Changes in Sales activity varied by market segment:

Single family sales fell 1.1 percent; condo sales jumped 18.7 percent; townhome sales declined 3.3 percent

Traditional sales rose 1.3 percent; foreclosure sales sank 44.1 percent; short sales fell 42.9 percent

Previously-owned sales were down 3.2 percent; new construction sales ramped up by 28.7 percent

From The Skinny Blog.

Weekly Market Report

For Week Ending December 8, 2018

The month of December often equates to a full-scale slowdown in residential real estate, as thoughts shift from buying homes to buying gifts and plane tickets to visit family and friends. This year could be different. The Federal Reserve is set to raise interest rates one more time in 2018. Interest rate hikes don’t necessarily create mortgage rate hikes, but they can. This may cause more purchase offers ahead of deeper affordability concerns in 2019.

In the Twin Cities region, for the week ending December 8:

- New Listings increased 1.4% to 773

- Pending Sales decreased 8.3% to 716

- Inventory increased 2.1% to 9,994

For the month of November:

- Median Sales Price increased 8.2% to $265,000

- Days on Market decreased 7.1% to 52

- Percent of Original List Price Received decreased 0.1% to 97.3%

- Months Supply of Inventory increased 5.0% to 2.1

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending December 1, 2018

While recent stock market activity has displayed some heart-pounding drops and rallying rises, that volatility has not created the same tidal waves within residential real estate. Increasing home prices and mortgage rates have indeed created a sense of immediacy for some buyers and turned others away due to affordability concerns, but these decisions appear to be rooted in longer-term trends rather than the effects of a media headline or presidential tweet.

In the Twin Cities region, for the week ending December 1:

- New Listings increased 7.0% to 877

- Pending Sales decreased 9.0% to 904

- Inventory increased 1.5% to 10,437

For the month of October:

- Median Sales Price increased 8.6% to $265,000

- Days on Market decreased 7.7% to 48

- Percent of Original List Price Received increased 0.2% to 97.9%

- Months Supply of Inventory remained flat at 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending November 24, 2018

With each passing week, it is evident that residential real estate markets across the nation are poised to finish 2018 with positive energy and room for optimism. Even in an environment of rising home prices and mortgage rates, we are finding relative balance in city after city when looking specifically at year-over-year trends. While it’s true that sales and new listings are down compared to last year at this time for some price ranges and home types, it is not often by much.

In the Twin Cities region, for the week ending November 24:

- New Listings increased 16.7% to 525

- Pending Sales decreased 7.2% to 670

- Inventory increased 2.0% to 10,852

For the month of October:

- Median Sales Price increased 8.6% to $265,000

- Days on Market decreased 7.7% to 48

- Percent of Original List Price Received increased 0.2% to 97.9%

- Months Supply of Inventory remained flat at 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.