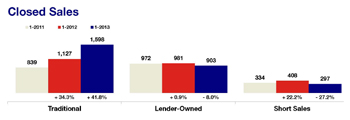

While we’re all exercising more and eating better – at least for another week – the local housing market has upheld several important resolutions. Four patterns continued from 2012: buyer demand was up, new and existing supply levels were down, prices were higher and distressed market activity eased. There were 2,797 closed home sales in January 2013, 11.0 percent higher than January 2012. There were 3,456 pending sales, a 13.3 percent increase over last year. Inventory levels declined 32.2 percent to 11,977 active listings, the lowest number for any month going back to January 2003. That marks an official 10-year low.

“Last year, traditional sellers re-entered the market in increasing numbers,” said Andy Fazendin, President of the Minneapolis Area Association of REALTORS®. “With our limited inventory, that’s led consumers to purchase more traditional properties, which sell for roughly 60 percent more than distressed properties.”

Traditional closed sales, in fact, were up 41.8 percent. That’s helped boost year-over-year median sales price comparisons for 11 straight months. The median home price was up 14.3 percent to $160,000. The 10K Housing Value Index – which adjusts for seasonality and segment bias – showed a tamer 8.2 percent increase to

$175,529. With the number of homes for sale at a 10-year low, seller confidence has become an increasingly vital component to continued housing recovery. There is evidence of improvement on this front, as traditional seller activity has been on the rise.

A healing distressed segment facilitated recovery. Traditional homes comprised 65.9 percent of all new listings, up from 56.3 percent last January, and made up 57.1 percent of all closed sales compared to 44.8 percent last year. In other words, fewer low-priced foreclosures and short sales both entered and sold off the market.

The traditional median sales price was up 3.6 percent to $199,900; the foreclosure median sales price was up 22.5 percent to $124,900; the short sale median sales price was up 2.9 percent to $125,500.